What is accounts payable?

Accounts Payable (AP) is an obligation that an individual or a company has to fulfill for purchasing goods and services bought from their suppliers and vendors. AP refers to the amount that is not paid upfront and can be paid back in a short period of time. Hence, a good or a service purchased on credit to be paid in a short period will fall under AP.

For individuals, AP may include the bill paid after availing services such as television network, electricity, internet connection, or telephone. Most of the time, the bill is generated after the designated billing period, depending upon the amount of consumption.

The customers have to pay this obligation within a stipulated time to avoid default.

What is accounts payable from a Company’s point of View?

AP is the amount of money a company is liable to pay to its suppliers or vendors and clear dues for purchases of goods and services purchased from its suppliers or vendors. AP is required to be repaid in a short period, depending on the relationship with suppliers. It is essentially a kind of short-term debt, which is necessary to honour to prevent default. As the current liabilities of the company, AP is required to be settled over the next twelve months.

It is presented in the balance sheet as the account payable balance.

For example, Entity A buys goods from Entity B for US$400,000.00 on Credit. Entity A has to pay back this amount within 60 days. Entity A will record US$400,000.00 as AP while Entity B will record the same amount as Account receivable.

AP is also a part of the cash flow statement. The change in the total AP over a period is shown in the cash flow statement, hence it is part of the company’s working capital. It is widely used in analysing the cash flow of the business and cash flow trends over a period. AP may also depict the bargaining power of the company with its vendor and suppliers.

A vendor or supplier may give the customer a longer credit period to settle the cash compared to other customers. The customer here is the company, which will incur AP after buying goods on credit from the vendor.

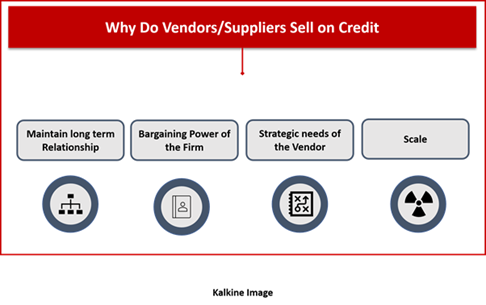

There could be many reasons why the vendor is providing a more extended credit period to the firm such as long-term relationship, bargaining power of the firm, strategic needs of the vendor, the scale of goods or services.

By maintaining a more extended repayment period to supplier and shorter cash realisation period from the customer, the company would be able to improve the working capital cycle and need funds to support the business-as-usual.

However, prudent working capital management calls for not overtly stretching the payable days as it might lead to dissatisfaction of supplier. Also, investors tend to closely watch the payable days cycle to determine the financial health of the business. When the financial conditions of a firm deteriorate, the management tends to delay the payment to their suppliers.

Why accounts payable is an important part of Balance sheet and Cash Flow Statement?

As inferred from the previous paragraphs, AP is part of the current liabilities of the balance sheet. This is an obligatory debt that has to be paid back within a time frame so that the company does not default. AP primarily consists of payments to be made to suppliers.

If AP keeps on increasing over a period of time, it can be said that the company is purchasing goods or services on credit more, instead of paying up front. If AP decreases, it means the company is reducing its previous debts more than it is buying goods on credit. Managing AP is essential to have a stable cash flow.

In a cash flow statement prepared through an indirect method, the net difference in AP is shown under cash flow from operating activities. The business entity can use AP to create the desired variation in the cash flow to some extent. For example, to increase cash reserves, management can increase the duration of paying back the credit taken for a certain period, thus affecting the net difference in AP.

What Is the Role of Accounts Payable Department?

Every company has an accounts payable department and the size and structure depend upon how big or small the enterprise is. The AP department is formed based on the estimated number of suppliers, vendors, and service providers the company is expected to interact with; the amount of payment volume that would be processed in a given period of time; and the nature of reports that a management will require.

For example, a tiny firm with a low volume of purchase transactions may require a simple or a basic accounts payable process. However, a medium or a large enterprise may have a accounts payable department that may require a set of practices to be followed before paying back the credit.

What is the Accounts Payable Process?

Guidelines or a process is important as it provides transparency and smoothness in facilitating the volume of transactions in any time period. The process involves:

- Bill receipt: when goods were bought, a bill records the quantity of goods received and the amount that needs to be paid to the vendors.

- Assessing the bill details: to ensure that the bill or invoice copy includes the name of the vendor, authorization, date of the purchase made and to verify the requirements regarding the purchase order.

- Updating book of records after the bill is collected: Ledger accounts need to be revised on the basis of bills received. The department makes an expense entry after taking approval from management.

- Timely payment processing: the department takes care of all payments that need to be processed on or before their due date as mentioned on a bill. The department prepares and verifies all the required documents. All details entered on the cheque along with bank account details of the vendor, payment vouchers, the purchase order, and the original bill and purchase order are scrutinized.

The department also takes care of the safety of the company’s cash and assets and prevents:

- reimbursing a fake invoice

- reimbursing an incorrect invoice

- making double payment of the same vendor invoice

Apart from making supplier payments, AP departments also takes care of travel expenses, making internal payments, maintaining records of vendor payments, and reducing costs

- Business Travel Expenses: Bigger entities or firms whose business nature requires all personnel to travel, have their AP department manage their travel costs. The AP department manages the personnel’s travel by making advance payments to travel companies including airlines and car rentals and making hotel reservations. An account payable department may also deals with requests and fund distribution to cover travel costs. After business travel, AP may also be responsible for settling funds supplied versus actual funds spent.

- Internal Payments: The Accounts Payable department takes care of internal reimbursement payments distribution, controlling and petty cash controlling and administering, and controlling sales tax exemption certificates distribution.

- Internal reimbursement payments include receipts or both substantiate reimbursement requests.

- Petty cash controlling and administering includes petty expenses such as out-of-pocket office supplies or miscellaneous postage, company meeting lunch.

- Sales tax exemption certificates comprise AP department handling sales tax exemption certificates supply to managers to make sure qualifying business purchases excludes sales tax expense.

- Maintaining Records of Vendor Payments: Accounts Payable maintains information of vendor contact, terms of payment and information of Internal Revenue Service W-9 either manually or on a computer database. The AP department lets management know through reports on how much the business owes at present.

- Other Functions: The accounts payable department is also responsible to lessen costs by identifying cost structures and creating strategies to reduce the spending of business money. For example, minimising cost by making payment of the invoice within a discount period. The AP department also acts as a direct point of contact between an entity and the vendor.

How to Calculate Accounts Payable in Financial Modelling

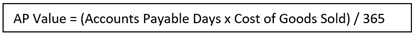

Financial modelling enables calculating the average number of days a company takes to make bill payments. AP days can be calculated using the following formula:

AP value can be calculated using the following formula:

What is accounts payable turnover ratio?

AP turnover ratio shows the capability of a firm to pay cash to its customer after credit purchases. It is counted as an essential ratio to analyse the cash management attribute of the firm and its relationship with vendors or suppliers.

It is calculated by dividing purchases by average AP.

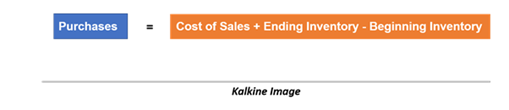

Purchases by the company are calculated as the sum of the cost of sales and net inventory in a given period:

Now let’s understand this with the help of an example. Let us suppose, Cost of sales of Company XYZ for the period was $60,000, and XYZ began with inventories worth $21000 and ended at $15000. AP at the beginning was $20000, and $15000 at the end.

Now the purchases will be $66000 (60000+21000-15000). The average AP will be $17500. Therefore, the AP turnover ratio will be 3.77x.

Dividing the number of weeks in a year by the AP turnover ratio will give the number of weeks the company takes on average to settle its payables. In this case, it will be around 13.8 weeks (52/3.77).

What is the difference between Accounts Payable vs. Trade Payables?

Though the phrases "accounts payable" and "trade payables" are used interchangeably, the phrases have slight differences. Trade payables is the cash that a company is obligated to pay to its vendors for goods and supplies which are part of the inventory. Accounts payable include all of the short-term debts or obligations of a company.

Please wait processing your request...

Please wait processing your request...