How can we define account statements?

An accounting statement can be defined as the periodic summary of all the credit and debit activities within a business with a starting date to an ending date. We often receive account statements from the insurance companies stating the outline of the paid in cash values. Apart from that, accounting statements can be obtained from any place where there is a constant transaction taking place. For example, the Paytm transaction history, credit card transaction summary, savings account transaction record, etc.

Summary

- An account statement is the summarised form of all the transactions made by an individual or a business over a specific period.

- It is a periodic statement sent over to the customer monthly or yearly to have a record of all their transaction histories.

- An account statement also restores invoices, payment details and few personal details of the customer.

- The other components of an account statement are date range, opening balance, invoice amount, the amount paid, and balance.

Frequently Asked Questions (FAQ)

How are account statements used?

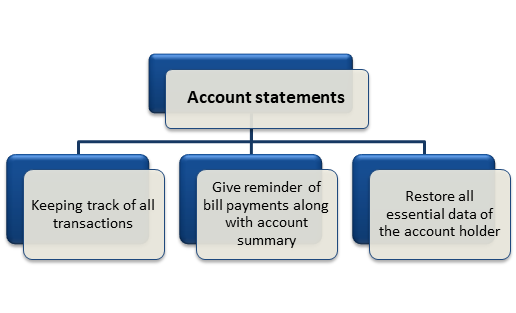

Account statements are essential for keeping track of all the transactions that are happening and developing a budget. In the case of an account statement of credit, it will show the outstanding amount along with interest, deadlines along with late fine charge when the installments are not paid on time. Thus, account statements could also be utilised by people to keep track of their payment deadlines.

The account statements also restore other essential data with respect to the account holder, such as the deadline of payments or the estimated time required to repay the debt through installment payments.

Image source: Copyright © 2021 Kalkine Media

The customers are also provided with a periodic account statement reflecting their level of consumption, unpaid bills, prepaid bills, and the amount due. For example, the utility companies such as television or internet subscription, OTT platform subscription, electricity service, etc.

The utility companies generally prepare an account statement at the end of every month and send it across to their customers, giving an overview of the total consumption of the service. The account statement also reflects the debit paid to the account; the credits received, account maintenance fees, state tax charges, and so on.

What are the components of an account statement?

An account statement is a summary of all the transactions made by an individual over a period. The following are the elements of an ideal account statement:

- Date range: Date range refers to the time interval that is being covered by the account statement. It could either be a summary of a week or a month, a quarter or a year.

- Opening balance: The initial starting balance in your account before making the transactions of the following month or year.

- Invoice amount: Invoice amount refers to the total number of goods or services purchased by that person over a specific period of time.

- Amount paid: The amount paid refers to the section of the account statement that says the total amount of money spent by that individual in that specific time period.

- Balance due: The due balance section of the account statement says the amount of money left in the account after making all the transaction over that specific time period.

In the typical format of an account statement, the personal details of an individual, such as name, address, phone number, e-mail address, etc., appears at the top. The components mentioned earlier appear below the personal details.

What is the significance of account statements?

The purpose of the account statement is to provide a summary of all the products and services purchased over a specific period of time. Any amount of money paid during this period reflects on the account statement. Any amount that yet to is paid also reflects on the account statement along with the total remaining account balance.

The customer also uses an account statement to raise any sort of concern to the service provider or the financial institute related to any transaction that has taken place from their end.

The account statement also plays a crucial role and comes in handy while checking the consistency of records in a customer's account. The business can have an overview of the transactions made by the customer and verify them. If any payment is due or missed, the company can send over a reminder through the account statement to the customer.

In case of technical error, a situation may arise where the customer is charged twice for a particular service or product. In that case, the business can review the account statement and resolve the matter efficiently.

The account statement makes it easier for the recurring customers to review their invoices which they receive periodically from the service providers. It is easier to view all the purchased products and the transactions that took place between them. Any sort of inconsistency can be easily detected and rectified.

Who are responsible for creating account statements?

Usually, the accountants of every business organisations are responsible for creating the account statements. The accountants are people who audits every credit and debit activities within a business and evaluate the remaining fund of that organisation. They prepare a report that begins with stating the initial starting account balance of the account holder followed by the time frame i.e. the starting and the ending date, followed by the transaction details and lastly, the remaining account balance.

Please wait processing your request...

Please wait processing your request...