What is Accepting Risk?

Accepting Risk, also called "risk retention," is a risk management approach in business or investment fields. It occurs when a company or individual recognises that the potential loss from risk isn't worth the cash investment to avoid it. Under this approach, infrequent and tiny risks are handled if and after they arise. Only the catastrophic or too expensive ones are worth acknowledgement. This kind of risk management could be beneficial while prioritizing major expenditures during the budgeting process.

Summary

- Risk Management has various approaches- either avoid, transfer, mitigate or accept risks.

- The choice of taking Risk tries to ensure little potential financial distresses by choosing to spend less for risks that don't pose much of a threat.

- It is a conscious choice and doesn't mean that organisations don't have contingency provisions for these risks.

Frequently Asked Questions (FAQs)

Why Accept Risks?

Accepting Risk is when business leaders or management identify risks but don't cut back or diminish them. The potential loss from the recognised and accepted Risk are considered tolerable.

It is a risk management strategy when the price of bearing risks is comparatively lower.

Risk acceptance is an option when chances are not disastrous or costly. Efforts are not taken to manage them. Impacts are usually tolerable or inexpensive, and risks are thus accepted and treated as they occur. Risk acceptance is, therefore, successful ranking risks and eventuality reducing budgets.

Accepting Risk carries a sense of self-assurance. The choice of taking Risk tries to ensure little potential financial distresses. However, organisations can sometimes accept retaining a terrible risk whose costs may not be financially feasible.

Image Source: © Robwilson39 | Megapixl.com

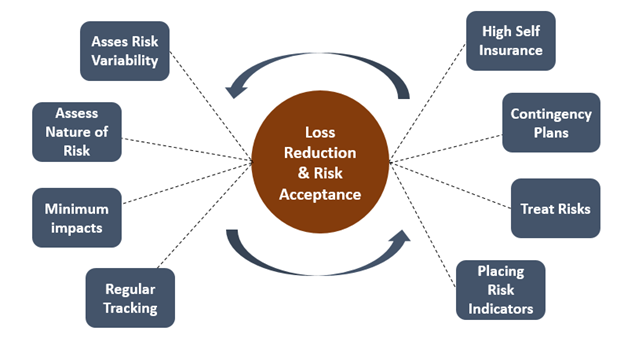

How is loss reduction ensured while Accepting risk?

Accepting Risk doesn't mean that management doesn't have conservative provisions in place. Though risk mitigation budgets are not assigned, still few things are ensured before Accepting risks. These are-

Copyright © 2021 Kalkine Media

It is essential to assess the nature of risks accepted and their variability. Management needs to double-check that these risks are treated well. It should self-assured that if risks materialise, the impact is minimal. It is why, even though low priority, such Risk need regular tracking and useful indicators in place. The company can prepare a contingency reserve or a low cost and hassle-free contingency plan.

When is it unsafe to Accept Risks?

Often risk acceptance becomes unsafe if there is-

- Lack of planning - many risks tagged as low priority though not consciously, but because there's no mitigation plan. Execution of the program isn't planned. During the Risk Assessment exercise, there's a minimum risk identified for mitigation. This remains as such for a year or more if assessments are infrequent. There is a potential risk acceptance failure in this case if the risks are variable.

- Lack of data - Sometimes, risks and impacts aren't communicated to decision-makers. It happens because the chances are known, but they're an unwillingness to share bad news. Sometimes effects are unknown. If risk assessment wasn't sufficient or failed to share information again, the actual Risk is not identified.

Risk Acceptance must therefore be a very conscious decision. Acceptance of Risk also shouldn't mean that organisations aren't prepared for potential risk mitigation actions. When addressing risk mitigation, organisations must remember that Risk Acceptance is an option. Do Nothing is often the best solution.

Due attentiveness is needed in ensuring that a scarcity of data or planning doesn't support the choice. It, instead, must be based on a conscious and meticulously measured plan. Accepting Risk comes with limitations, determined by a firm's capacity to absorb financial consequences in the event of a risk. It's essential to managers and business strategists that they have to choose risk retention policies wisely.

What are the options to Risk Acceptance?

Risk is not always accepted. It is a conscious choice. Thus after assessing various risks, organisations choose to accept, avoid, mitigate or transfer the risks. While accepting Risk an appropriate choice in many situations, the other approaches of risk management are:

Copyright © 2021 Kalkine Media

- Risk transfer-risks can be transferred from one party to another on a contractual basis. Essentially the impacts on the materialisation of risks are transferred from one party to the other. This kind of allocation confirms responsibility for Risk on a party who has the capability to regulate and insure against the danger. This a commonly adopted tactic by insurance companies.

- Risk avoidance –it is the method of escaping events that pose potential loss. For catastrophic risks, this is the best option. Any severe impact on business continuity is avoided. Managers accomplish risk avoidance by creating policies and procedures, implementing technologies and training. In Factories where chances of huge loss due to asset failure are possible, such a Risk management strategy works well.

- Risk mitigation –it should be the last resort. When a risk has already materialised, or the possibility is very high, limiting the results is necessary. Such a strategy prepares organisations for the worst situations. The best way to do this through hedging. This is what investors do when they see unfavourable price movements.

Please wait processing your request...

Please wait processing your request...