AAPL 166.95 -0.625% MSFT 405.53 -1.5321% GOOG 157.87 0.6311% GOOGL 156.33 0.5532% AMZN 179.16 -1.1695% NVDA 845.7765 0.6457% META 501.88 1.5602% TSLA 150.58 -3.1328% TSM 132.2437 -4.8812% LLY 745.5808 -0.6912% V 270.24 -0.8985% AVGO 1265.27 -1.3535% JPM 181.285 0.6691% UNH 496.0 3.5512% NVO 122.7001 -1.4694% WMT 59.37 -0.4694% LVMUY 170.6 -0.0878% XOM 118.21 -0.354% LVMHF 858.46 0.0536% MA 454.515 -1.2267%

Section 1: Company Fundamentals

1.1 Company Overview:

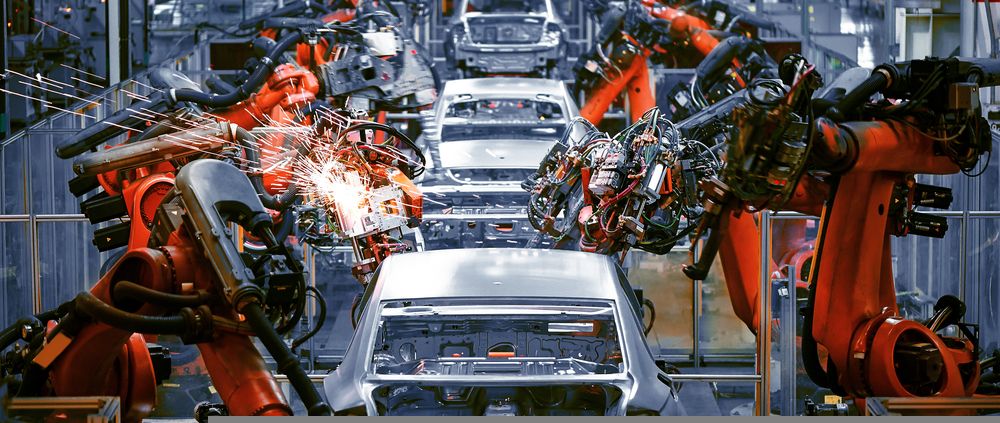

Ford Motor Company (NYSE: F) is an automobile company. The Company designs, manufactures, markets, and services a full line of electrified passenger and commercial vehicles, such as Ford trucks, utility vehicles, vans, and cars, and Lincoln luxury vehicles. The Company's segments include Ford Blue, Ford Model e, Ford Pro, Ford Next and Ford Credit.

Kalkine’s Daily Report covers the Company Overview, Key positives & negatives, Business updates and insights into company recent financial results, Key Risks & Outlook, Price performance and technical summary, Target Price, and Recommendation on the stock.

Stock Performance:

1.2 Summary Table

1.3 The Key Positives, and Negatives:

1.4 Key Metrics:

Ford Motor Company has demonstrated remarkable cost management proficiency across its operations, resulting in superior profitability margins compared to industry peers. This accomplishment can be attributed to the company's effective operational practices implemented at various levels. Additionally, Ford has made notable progress in generating free cash flow during the first quarter of the fiscal year 2023. This positive development is a result of the company's heightened effectiveness in all operational aspects, thereby strengthening its cash flow position. Ford's adeptness in cost management and the subsequent achievement of higher profitability margins have played a significant role in enhancing its free cash flow performance. These accomplishments highlight the company's unwavering commitment to maximizing operational efficiency and maintaining a strong financial position.

Section 2: Ford Motors Company (“Buy” at the closing market price of USD 12.09, as of May 26, 2023)

2.1 Company Details

2.2 Technical Guidance and Stock Recommendation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is May 26, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.